Life insurance is one of the most important parts of financial planning — but one of the most confusing questions people face is:

“How much life insurance do I actually need?”

Buy too little, and your loved ones may struggle financially after you’re gone. Buy too much, and you may end up paying higher premiums than necessary.

The key is finding the right balance — enough coverage to protect your family’s future without overpaying. In this article, we’ll walk you step-by-step through how to calculate how much life insurance you need and what factors to consider.

1. Understand the Purpose of Life Insurance

Before crunching numbers, it helps to remember why you’re buying life insurance in the first place.

The main goal of life insurance is to replace your income and cover your family’s financial needs if something happens to you. It ensures that your loved ones can:

-

Pay for everyday expenses

-

Cover major debts (like a mortgage)

-

Fund education or future goals

-

Maintain their current standard of living

So, the amount you need depends on your financial responsibilities, income, debts, and future goals.

2. Use the “10–15 Times Income” Rule (Simple Estimate)

A quick way to get a rough estimate is to use the income replacement rule of thumb.

Many financial experts recommend:

💡 Life Insurance Coverage = 10 to 15 times your annual income

For example:

If you earn $50,000 per year, you should have between $500,000 and $750,000 in life insurance coverage.

This method provides a starting point — enough to cover years of income for your family while they adjust and plan for the future.

However, this is just a basic guideline. For a more accurate figure, you’ll want to look deeper into your personal financial situation.

3. Step-by-Step Method: The DIME Formula

The DIME formula is a more detailed way to calculate how much life insurance you really need. It stands for:

D = Debt

I = Income Replacement

M = Mortgage

E = Education Expenses

Let’s break each part down:

D – Debt

Add up all your outstanding debts (credit cards, personal loans, car loans, etc.) excluding your mortgage — we’ll cover that next.

Your life insurance should be enough to pay these off so your family isn’t left with financial stress.

Example:

Credit card debt: $5,000

Car loan: $10,000

Personal loan: $7,000

Total Debt = $22,000

I – Income Replacement

Think about how many years your family would need your income to maintain their lifestyle.

A common recommendation is 10 years of income replacement.

Example:

If you earn $60,000 per year × 10 years = $600,000

This ensures your family has a stable income while adjusting to life without you.

M – Mortgage

Your mortgage is likely your biggest financial obligation. Include the total amount needed to pay off your home loan so your family can keep the house without worrying about payments.

Example:

Mortgage balance = $180,000

E – Education Expenses

If you have children, include the estimated cost of their future education.

Tuition and related expenses can be high, so plan accordingly.

Example:

2 children × $40,000 each = $80,000

Now, Add It All Up:

Using the above example:

So, this person would need roughly $900,000 in life insurance coverage.

This gives a realistic estimate of how much money your family would need to stay financially secure.

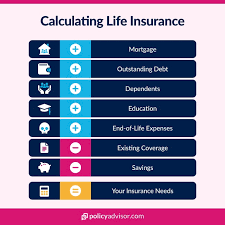

4. Don’t Forget to Subtract Existing Assets

Once you calculate your total needs, subtract any assets your family could use if you were gone.

Include things like:

-

Savings and emergency funds

-

Investments (stocks, mutual funds, etc.)

-

Existing life insurance or employer-provided coverage

-

Retirement accounts (if they can be accessed)

Example:

If your total life insurance need is $900,000 but you already have $150,000 in savings and $100,000 in investments, you only need:

$900,000 − $250,000 = $650,000 in coverage

This ensures you’re not overinsured and wasting money on unnecessary premiums.

5. Consider Future Goals and Inflation

Don’t just think about today — consider your long-term goals and how inflation affects the value of money.

A $500,000 policy today may not be worth as much 20 years from now. As a general rule, factor in 3–4% inflation per year and consider any future life events, like:

-

Having more children

-

Buying a larger home

-

Supporting aging parents

-

Starting a business

Your life insurance should grow with your life stage.

🔄 Tip: Review your policy every 2–3 years** or after major life changes to make sure your coverage still fits.

6. Decide Between Term and Permanent Life Insurance

How much you need also depends on the type of policy you choose:

Term Life Insurance

-

Covers you for a fixed period (e.g., 10, 20, or 30 years)

-

Much cheaper and ideal for income replacement during working years

-

Best for families with mortgages, kids, or temporary obligations

Permanent Life Insurance

-

Covers you for life

-

Includes a cash value component that grows over time

-

More expensive, but builds long-term wealth and can be used for retirement or estate planning

💬 Pro Tip: Many people choose a term policy for basic protection and add a smaller permanent policy for lifelong coverage and investment growth.

7. Adjust for Your Family’s Lifestyle

Your family’s lifestyle and spending habits also affect how much life insurance you need.

Ask yourself:

-

How much does my family spend monthly?

-

Do we have a high standard of living to maintain?

-

Are there dependents who rely on me financially?

If your family spends $4,000 a month, you’d need enough coverage to replace that for several years — not just your income alone.

🧮 Example: $4,000 × 12 months × 10 years = $480,000

That’s just for living expenses — you’d still need to add debts, mortgage, and education on top.

8. Use Online Life Insurance Calculators

If numbers overwhelm you, don’t worry — there are plenty of free life insurance calculators available online.

These tools ask for details like your income, debts, dependents, and assets, then calculate your recommended coverage automatically.

While these tools are helpful, it’s still smart to talk with a licensed financial advisor who can tailor coverage to your unique goals.

9. Review and Reassess Regularly

Life changes — and your life insurance should too.

Revisit your coverage whenever you experience major life events like:

-

Marriage or divorce

-

Having children

-

Buying a new home

-

Changing jobs or income level

Adjusting your policy ensures your loved ones are always protected without overspending on premiums.

Conclusion

Calculating how much life insurance you need doesn’t have to be complicated.

By using simple methods like the DIME formula, considering your debts, income, and future goals, and subtracting existing assets, you can find the right amount of coverage for your situation.

The goal isn’t just to buy life insurance — it’s to buy enough to protect your family’s financial future.

🌟 Remember: The right life insurance policy isn’t about guessing — it’s about planning smartly for the people who matter most.